In my role as CEO of Germanedge, I am constantly tasked with keeping a bird’s eye view on the macro trends that shape our world and determine Germany’s position as an industrial heavyweight.

Just a few weeks ago, I delved into the worrying digital lag of Germany’s industrial sector that will seriously threaten our economic attractiveness in the future.

Today, I want to address another equally compelling trend that is rapidly emerging, warranting our attention and deep introspection.

The Winds of Change in Global Trade

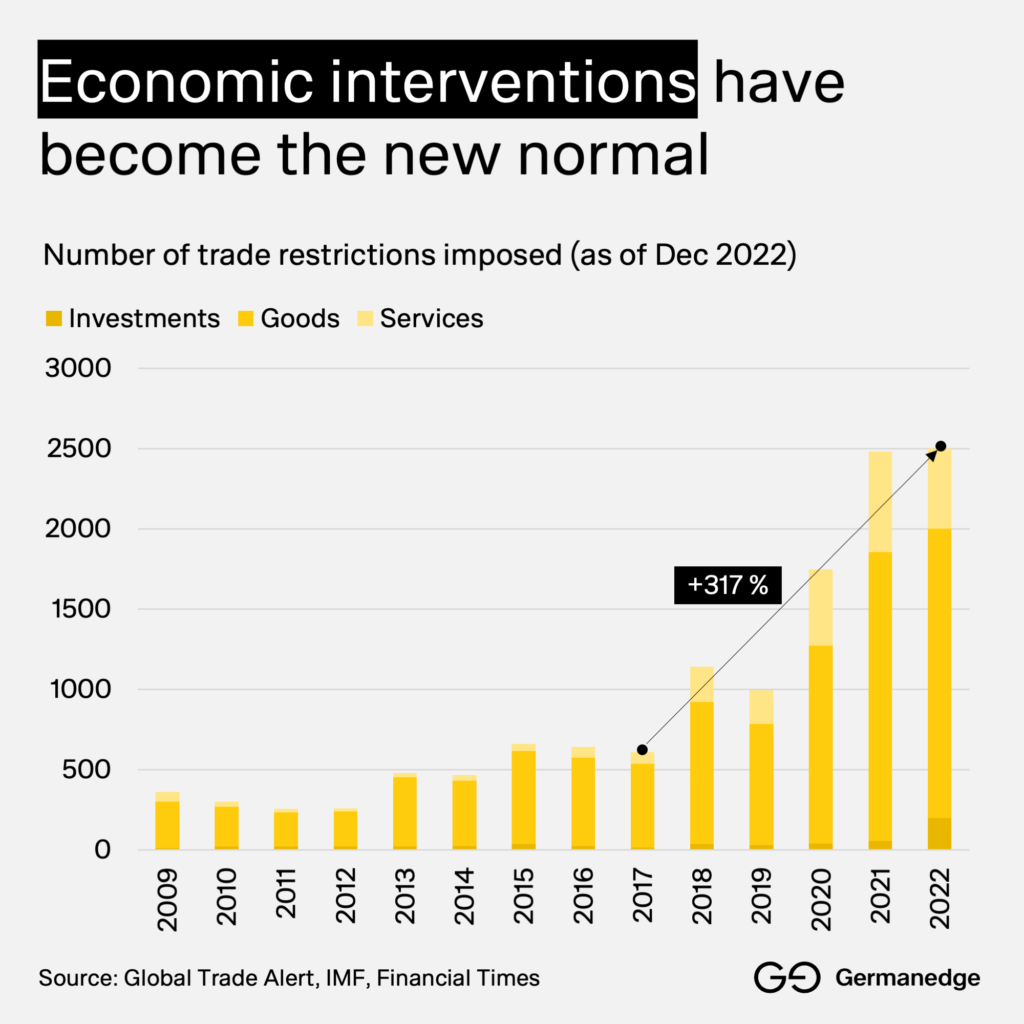

The global economy is undergoing a significant metamorphosis, with signals of de-globalization taking center stage.

Spurred by geopolitical tensions, such as the trade conflict between the U.S. and China, the Russia vs. Western countries’ stand-off, and the Israel-Palestine tragedy, we are witnessing a seismic shift in how global trade and business operate.

Supply chains, once sprawling and interconnected, are being reconsidered and reconfigured.

The consequence?

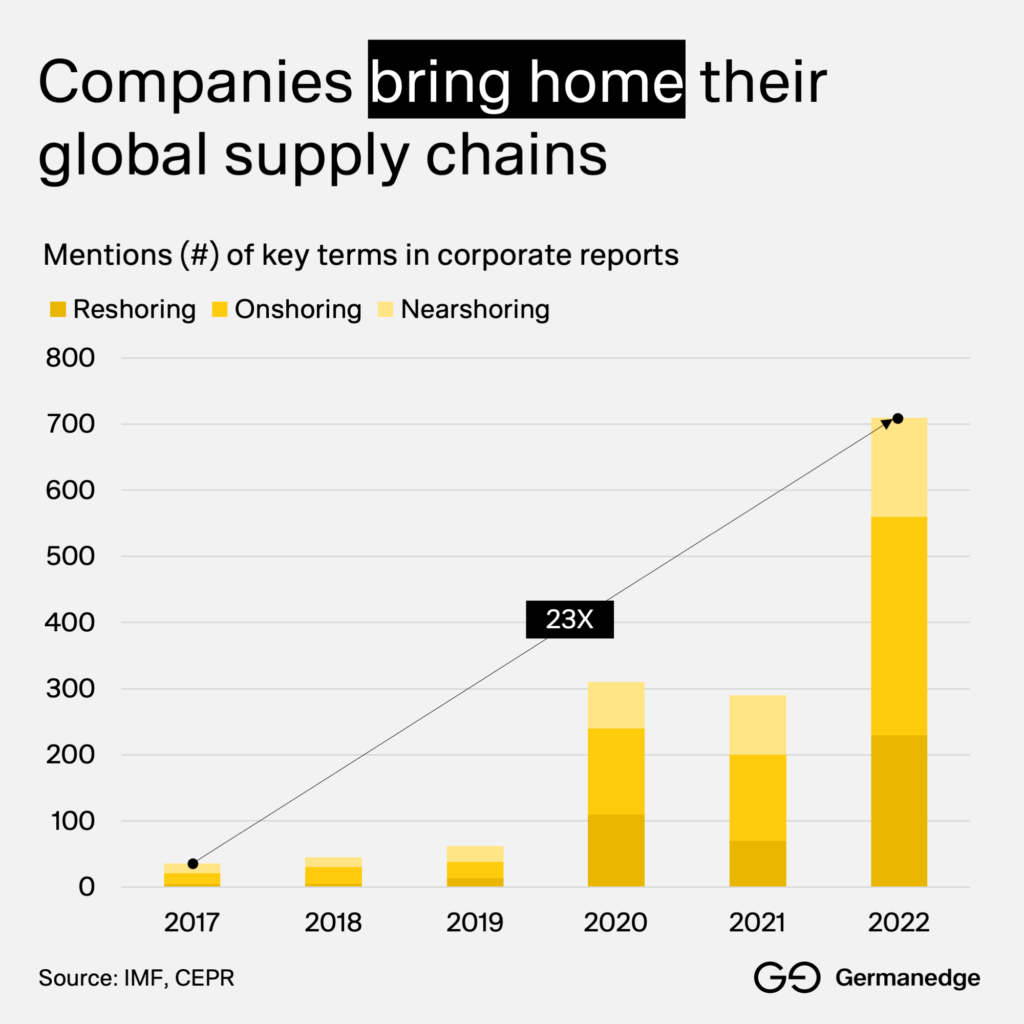

A notable rise in protectionist actions, accompanied by a rapidly increasing focus on “home-shoring” supply chains.

This movement is not just a short-term trend du jour.

The move towards domestic supply chains has played a pivotal role in boardroom discussions, affecting small businesses the same way as multinational corporations.

Where is this shift most visible? The answer: the industrial sector.

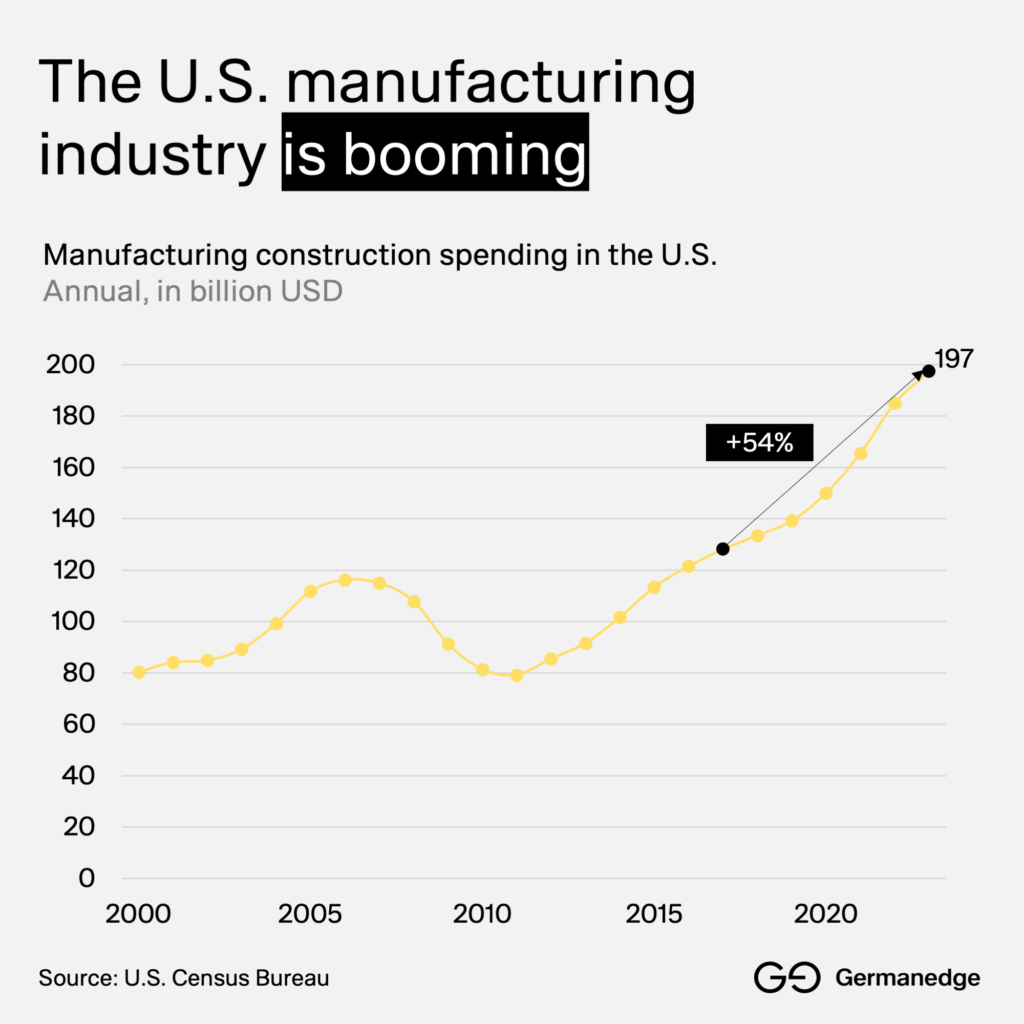

Nowhere is this more evident than in the United States.

America’s Industrial Renaissance

Under the Biden Administration, there’s a renewed emphasis on industrial policy, a push towards self-reliance, and significant government spending on domestic (clean) energy like batteries and solar, semiconductors, and home-grown manufacturing.

We only need to observe the surge in manufacturing-related construction investments to appreciate the massive momentum building up.

Some pundits are even coining this phenomenon as the “manufacturing supercycle” taking root in the U.S.

This backdrop sets the stage for my exploration today.

- What does this trend mean for the German industrial sector?

- And how will it impact our future in the unfolding Industry 4.0 era?

Let’s take a look.

But first, let’s assess the manufacturing case of Germany.

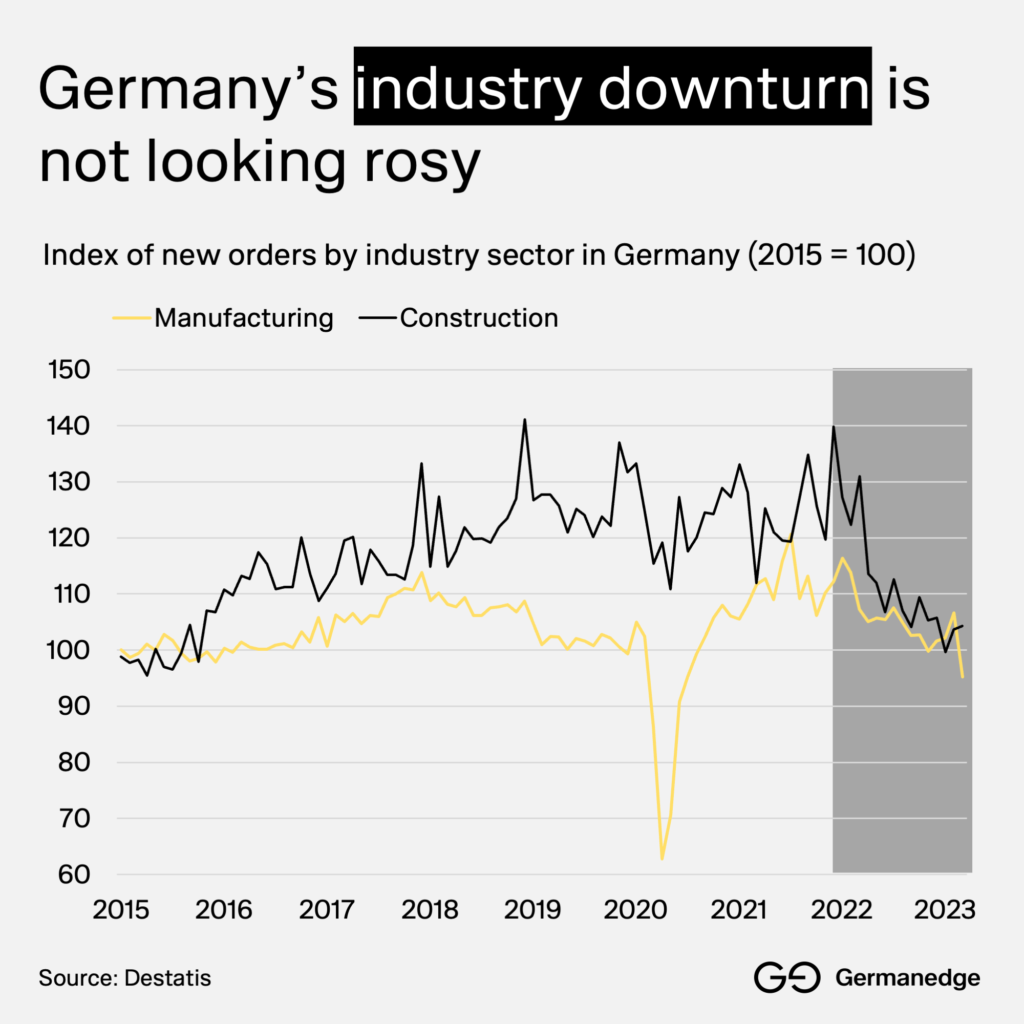

Germany’s Industry Stalls

While the U.S. experiences an industrial renaissance, Germany paints a more contrasting picture. It’s paramount to understand that the macro trends reshaping America’s manufacturing horizon are not universally echoed, particularly not in our homeland.

Official data from Destatis underscores this divergence.

- New orders in manufacturing have seen a steady decline since late 2021.

- Digging deeper into the construction domain, the dip has become even more pronounced over the past two years.

This downturn isn’t merely a statistical anomaly; it carries real-world implications for the economy at large.

The German economy is poised to plateau in the third quarter of 2023.

This stagnation deviates from earlier forecasts projecting modest growth.

A blend of factors contributes to this: dwindling purchasing power, rising interest rates, and notably thin factory order books.

Germany’s Pivot to the U.S.

In light of the burgeoning U.S. industrial supercycle and Germany’s manufacturing decline, it’s hardly surprising that numerous German companies are casting their gaze across the Atlantic, enticed by America’s favorable business climate.

Cheaper energy costs, paired with potential subsidies via the Inflation Reduction Act (IRA), are just two of the factors pulling Germany’s corporate juggernauts westward.

- For instance, BMW recently made waves by injecting a staggering $1.7 billion USD into its U.S. factory situated in Spartanburg, South Carolina.

- Mercedes-Benz plans to massively expand its SUV factory in Tuscaloosa, Alabama, as Handelsblatt reported earlier this week.

- Other German powerhouses such as Audi and Siemens Energy are also zeroing in on the U.S. as the prime location for fresh production facilities.

- And most worrisome, it isn’t only the giants of German industry that are turning their attention stateside. The backbone of Germany’s economy, the small-to-medium-sized enterprises (SMEs) that comprise the Mittelstand, are equally enticed. A case in point is Meyer Burger, a Swiss-based firm with major production factories in Germany. As Europe’s last-standing solar cell manufacturer, its shift indicates a broader trend in the cleantech sector’s relocation aspirations.

To label these moves as mere isolated incidents would be a grave misjudgment.

While the U.S. market, with its vast customer size, has long been alluring to German companies, the current traction we’re witnessing is unparalleled.

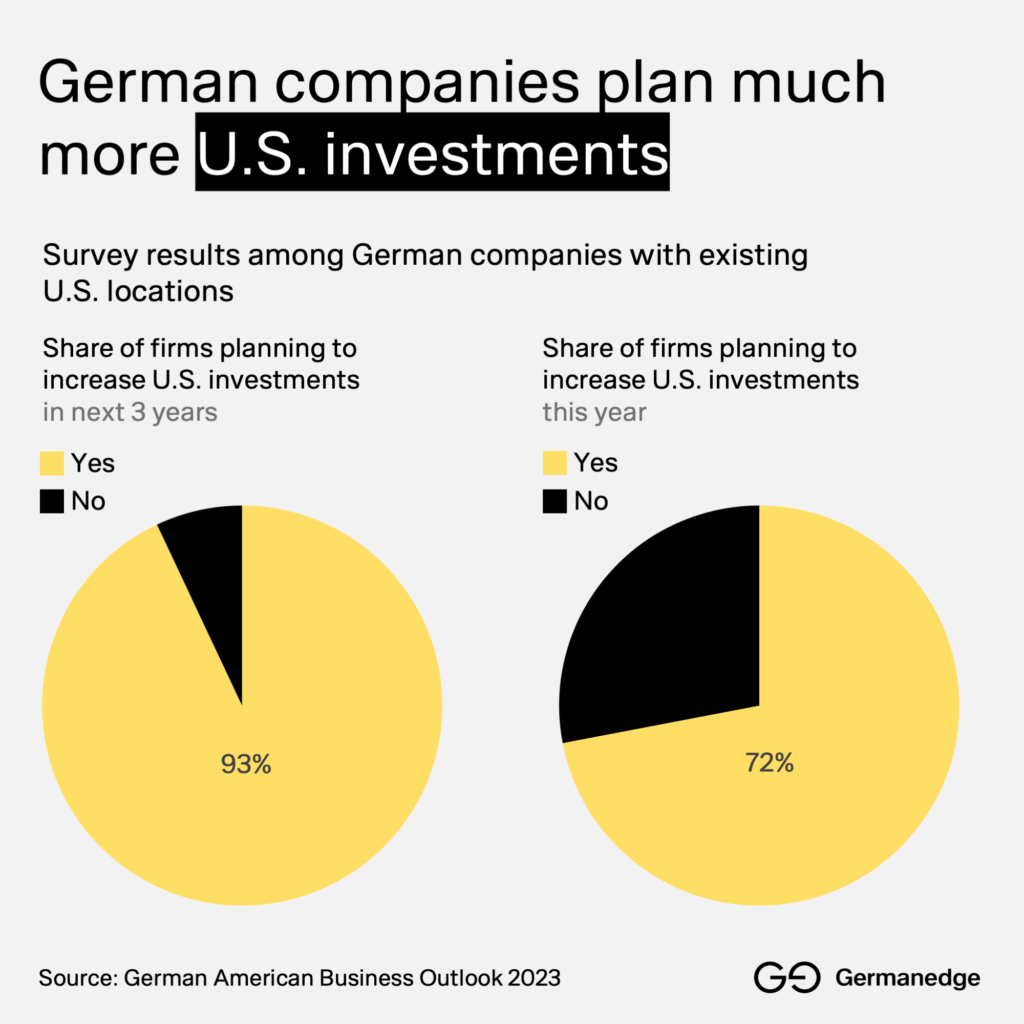

The German American Business Outlook 2023 underscores this sentiment.

- Their findings reveal that a remarkable 93% of companies surveyed are set on amplifying their U.S. investments within the next three years.

- Moreover, 72% are geared to upscale their U.S. commitments within this very year.

Notably, it’s the automotive, transportation, and logistics sectors that are at the forefront of this surge, with an ambitious 22% setting their sights on investments north of $10 million USD by 2025’s close.

Germany’s Export Model is at Risk

As the CEO of Germanedge, one thing remains top of mind for me: Germany’s global reputation as the “Exportweltmeister” – the world champion of exports.

This title isn’t just a label; it’s a reflection of our historic industriousness, innovation, and international competitiveness.

Yet, we are at a pivotal moment where this title and, more critically, the foundational strengths it represents, are at risk.

As I engage with industry peers and delve deeper into the motives behind their strategic decisions, a recurring theme emerges.

Surprisingly, the allure of the U.S. isn’t solely based on its manufacturing boom or policy incentives.

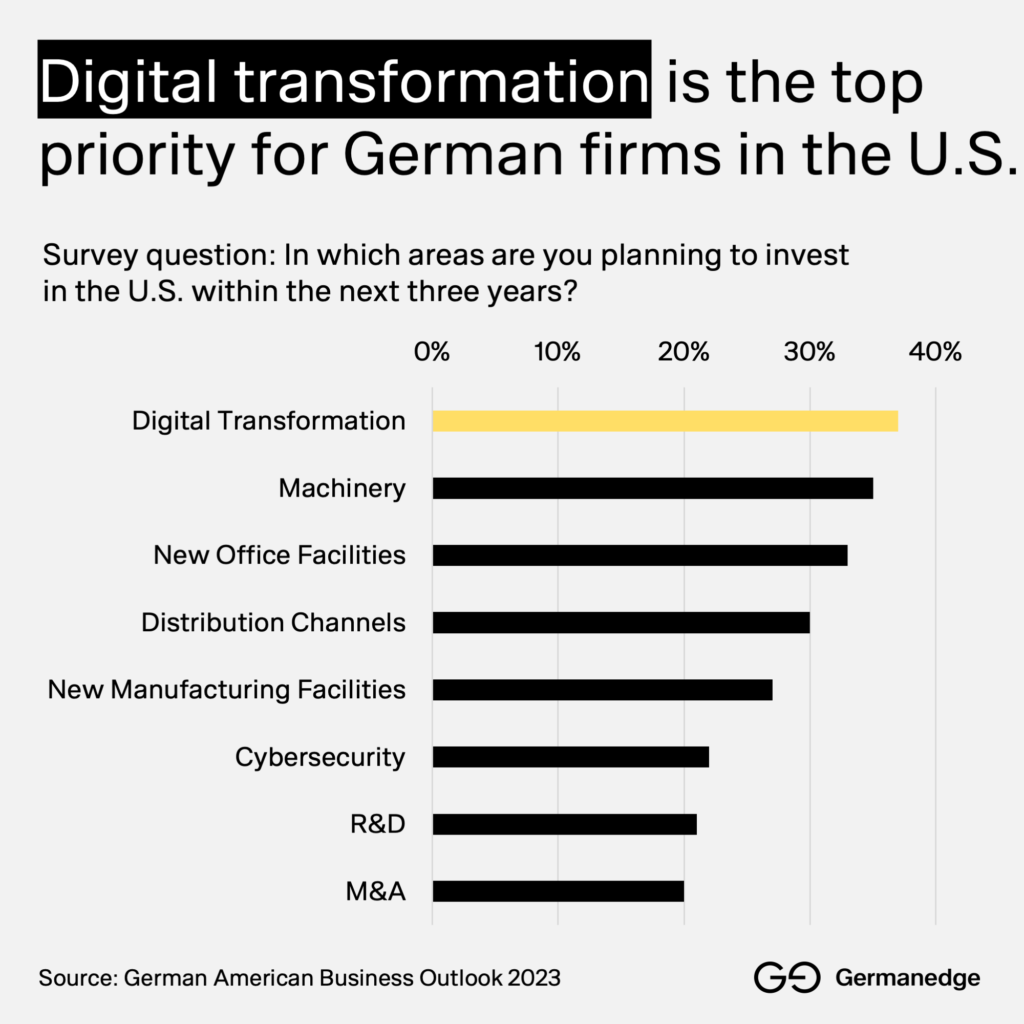

It’s here, where the tide seems to be turning: Leading the charge of investment areas for German companies looking westward is “Digital Transformation.”

This finding is also supported by recent survey data where digital transformation trumps all other motives for firms to move production across the Atlantic.

The irony isn’t lost on me – it’s the same area where our homeland lags, as I highlighted at the outset.

As German companies pour resources into the American digital ecosystem, they inadvertently sideline local investment, potentially furthering the divide and slowing down our national digital advancement.

This overseas migration doesn’t just lead to missed opportunities on the home front; it potentially threatens the very fabric of our export-driven model.

So, the pressing question remains: What can and should we do to safeguard Germany’s industrial future and its digital stride?

A Call to Action

As I conclude this reflection on our industrial sector, it’s essential to clarify my intention.

My goal isn’t merely to highlight the challenges but to prompt us into action.

By sharing these observations, I want us to be aware, to take notice, and to mobilize.

In my conversations with fellow leaders and the Germanedge client base, a common theme emerges: Concerns about our economy and companies considering a move to the U.S. have become a standard topic. While businesses need to adapt and explore new opportunities, we must understand these decisions within the broader economic context.

The rise of U.S. manufacturing is undeniable.

Watching its growth and understanding its impact will shape our view of this decade’s economic landscape. But it’s more than just the immediate effects. If the U.S. maintains its growth in manufacturing while Germany faces economic challenges, the digital gap between the two nations will widen further. The U.S. has already demonstrated job growth, with their construction sector adding 192,000 jobs in the past year alone.

Yet, despite these challenges, I believe in Germany’s resilience and innovation. We can address these issues.

With the right mindset, strategies, and collaboration, we can bridge the digital divide and reclaim our role in the global industrial story.

For this to happen, it’s time for us to face these challenges, not with fear, but with determination and a recovered German “can-do” attitude.

How exactly?

Here’s my five-step emergency plan to recalibrate our German economic mindset:

Here is what I mean by these five elements:

Embrace Change: Besides an honest and analytical view of what’s happening around us, such as the manufacturing boom taking place overseas, we need the courage to take action. More than that, we need to embrace the changing world. There is no return to the past.

Foster Experimentation: Change inevitably leads to mistakes. However, fearing mistakes undermines our German pursuit of perfection. But standstill is not an option. Let’s start experimenting again! Let’s celebrate disruption, not fear it.

Simplify and Innovate: We must not only let go of our tendency for perfection but also our drive for complexity. Historically, these attributes accelerated German economic prosperity, but now they threaten our place in the global economic landscape. It’s essential to build upon our previous experiences rather than being bound by what worked in the past.

Lead with Courage: The path to re-industrialization in the digital era demands genuine leadership. We often lack the courage to truly lead because it means taking a stance. While our historical context might make this challenging, leadership is mission-critical to navigate uncharted paths!

Preach Digital First: To initiate the necessary “change of mindset” for the digital era, innovation and digital readiness must become the top priority. Digital transformation should be viewed as a pathway to progress, not merely as a necessary evil.

Committed to Germany’s (Digital) Evolution

At Germanedge, we aren’t just bystanders watching the transformative wave of digitalization; we are active participants driving change.

We’ve always held a bullish stance on Germany’s digital transformation potential (see our name), and for good reasons.

Our belief in the future of our economy goes beyond economic indicators.

It’s rooted deeply in our interactions and collaborations with the very companies that form the backbone of Germany – the small and medium-sized businesses.

These businesses are driven by passion, dedication, and an undying entrepreneurial spirit. Their eagerness to embrace Industry 4.0 and future-proof themselves is palpable in every interaction.

Yet, in these dynamic times, we often hear of the challenges they face – not necessarily from the evolving digital landscape, but from a lack of comprehensive support and a conducive business environment. When our clients contrast Germany’s regulatory framework with the substantial support offered to their international counterparts, such as the Inflation Reduction Act in the U.S., they express concerns about being left behind.

But our message to them, and to all German enterprises, is clear and consistent: Don’t waver. Keep pushing boundaries, stay committed to innovation, and remember we are still in the early days of Industry 4.0. As the landscape of digital production becomes smarter, more agile, and sustainable, it’s imperative we adjust our economic perspectives accordingly.

Germanedge is here to be a steadfast partner in this journey.

Together, let’s ensure that Germany not only stays relevant in this evolving digital age but leads the way with unmatched prowess.